Investment Management Advisory Services

Investment Strategy that Matches Your Financial Plan

EP Wealth Advisors® Creates Individualized, Goal-oriented Portfolios that Put Your Needs First

Is your investment management strategy tailored to your specific financial plan? Throughout the planning process, our financial advisors listen to you to understand your circumstances and short- and long-term goals, then construct a diversified portfolio designed to help you achieve your objectives. We believe the best way to accomplish this is by using an approach that seeks to maximize returns while managing risk through strategic portfolio diversification.

INVESTMENT PORTFOLIO MANAGERS

WHO SEE THE BIG PICTURE

How EP Wealth Advisors Helps You Invest in Your Plan

Each individual investor has unique financial goals, risk tolerance, and time horizon. A managed portfolio considers your timeline while keeping your portfolio strategy aligned with each phase of your life including ongoing monitoring and periodic rebalancing.

Our portfolio managers are objective and unbiased when it comes to selecting investments and the ways in which we invest: your advisor and portfolio manager may select individual stocks, mutual funds, ETFs, individual bonds, REITs, commodities, or alternative investments, depending on what's most appropriate for you.

Your EP Wealth team, led by your advisor, can also assist you with:

- Conducting a financial health assessment to identify gaps, risks, and opportunities

- Coordinating life goals like college tuition, weddings, travel, a new baby, or retirement

- Creating short-term and long-term investment strategies for asset allocation

- Maintaining alignment between strategy and risk tolerance, priorities, and goals

- Financial education that may include information and perspectives on life transitions planning, retirement planning, and estate planning

- Tax planning and developing strategies to retain as much personal wealth as possible

- Business planning to ensure responsible growth objectives, adequate insurance coverage, cash-flow management, business succession strategies, and alignment of personal and professional goals

Creating a Personalized

Creating a Personalized

Investment Portfolio

Take Advantage of a Dedicated Portfolio Manager

From that first phone call, you realize we’re not like other investment management companies. Our company founders began in 1999 to diverge from the conflicted Wall Street model of advising. We’ve always pursued a personalized approach, transparent fee structure, and client-first business philosophy.

Each investment account at EP Wealth Advisors is assigned a dedicated Portfolio Manager to ensure that a single person remains responsible for ongoing management and account oversight.

Your Portfolio Manager works with the asset allocation determined from your financial plan and makes decisions related to actions such as account location (based on tax efficiency), tax management, and your personal mandates such as restricted securities or liquidity management.

Additionally, each of our analysts is responsible for reporting on specific areas of coverage across sectors and asset classes to our Investment Committee, an internal group comprised of seven voting members that meet weekly to act as checks and balances for each client’s portfolio.

Market updates, and any potential changes in investment strategy are communicated to your EP Wealth Advisor via a weekly firm-wide conference call.

Building a Personalized Investment Portfolio

Align Your Portfolio with Your Personal Goals

You look for personalization in every aspect of your life - and finance is no exception. Access to a personalized approach was once relegated to very high-net-worth investors. At EP Wealth Advisors, we make this a customized approach available to all of our clients.

Personalization can mean:

- Building a diverse portfolio around existing investments

- Following the investor's philosophy

- Investing based on environmental, social, and governance values

- Thematic investing based on preferred sectors, interests, or appealing companies

Investment Management Supported by Institutional Research

Our Portfolio Managers Dive Deep Into the Data

While many people have investments, understanding and researching the wide array of domestic and international equity and fixed income asset classes, including both developed and emerging markets, takes a level of time, resources, and expertise that most individuals do not have.

Our experienced Investment Committee leads the overall strategic investment direction for the firm, and is supported by a broad team of experts, including analysts, portfolio managers, and traders. The members of the committee carefully review perspectives and input on capital markets, economic outlook, global environment, and other factors to set the long-term investment direction of the firm, including asset allocation, individual asset classes, and risk management. They work closely with each other and meet frequently to discuss the market outlook and changes in direction -- sharing the best ideas and working closely on your behalf.

We are objective and focused on informed research, so we work with respected independent research, analytics, and data firms such as Morningstar, Strategas Research Partners, and Bloomberg to combine expert analysis with market data for the assessment of your investment portfolio, leveraging those insights to help build the type of future you envision.

A Tax-Smart Investing Approach

Strategic Tax Planning and Preparation

Tax considerations are factored into our investment approach. Our tax-smart strategies may include:

- Capital gains management: When it's time to sell, we carefully review the tax implications to make portfolio decisions that are tax-smart and avoid surprises.

- Withdrawal advice: You want to tap your long-term investments for income - but how? We'll implement a plan to keep sufficient cash in your account and time your taxable and tax-deferred withdrawals carefully to avoid penalties or large tax bills.

- Tax-loss harvesting: Lower your tax bill by offsetting capital gains with capital losses.

- Distribution management: When selecting securities, we consider your exposure to additional income distributed by mutual fund investments and when they pay capital gains, dividends, or interest.

- Municipal bond investments: Depending on your situation, we may select municipal bond funds for your portfolio that generate interest exempt from federal - and in some cases state - taxes.

- Transition management: Selling off your existing investments when establishing a new portfolio can have a significant tax impact. We look for ways to integrate and transition old investments into new accounts when possible.

Financial Check-Up

Do you have more than $500,000 to invest?

Talk to us about a Financial Health Assessment today!

5 Questions to Ask About

Your Investment Portfolio

A Financial Advisor Can Bring a Fresh Perspective to Your Investment Strategy

Is now the right time to bring an investment advisor on board to manage your portfolio? Here are some key questions to ask yourself before reaching out to an investment manager.

If you’re young, single, and managing one brokerage or 401(k) account, your financial life may be relatively simple. But over a lifetime, it’s common to end up with a variety of investment accounts—old 401(k)s from former jobs, a few IRAs, inheritances, and independent brokerage accounts. It can be much more efficient to streamline your finances under one roof for enhanced visibility and ease of executing a cohesive plan.

You know investing is one way to build generational wealth—and the sooner you get started, the better—but what might be less clear are the implications of inflation, overseas volatility, and changes in the labor market. Working with an investment manager provides a valuable second opinion to confirm that you’re going in the right direction or to suggest new opportunities you hadn’t thought of before.

When you don’t have time to research your options, you open the door to impulsive, emotion-guided decisions that may not pay off in the long run. Your investment manager can help you adjust your life insurance plan, or decide whether to ramp up your 401(k) contributions. If you’re worried that you might be drifting from your original investment strategy, it may be time to let someone else take a fresh look.

Investment managers can help you navigate life’s many stages and transitions. Maybe you received a large inheritance or built up a substantial stock portfolio, started a business, or see retirement on the horizon. Perhaps you have a new spouse or you’re in the midst of a divorce. A new baby in the house, a child about to attend college, or caregiving needs for an aging parent—these are all reasons to take another look at how your investment portfolio is performing.

Quizzes on the Financial Industry Regulatory Authority website can be fun, but you still have to figure out how to apply what you’re learning to your own situation. Personalized advice becomes especially crucial when you reach a point when you have considerable wealth to invest. An investment advisor can walk you through the various options and integrate your investment strategy with other areas of your financial life, such as your liquid accounts, insurance coverage needs, debt management approach, cash-flow planning, charitable giving, or estate planning.

How We Manage Risk

Our Investment Breakdown Balances Stocks and Bonds

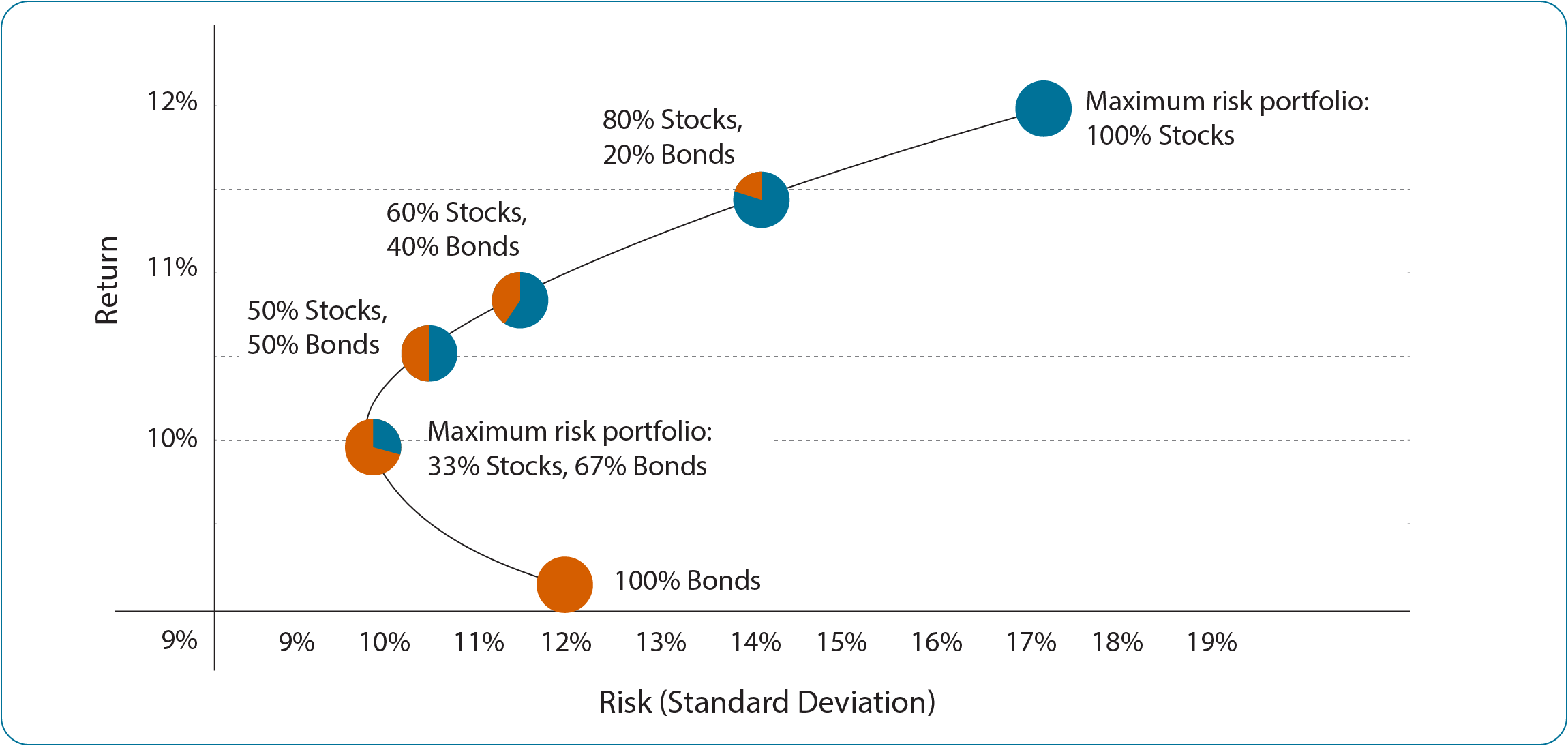

In order to manage risks, our advisors follow the modern portfolio theory (MPT) approach.

By looking at your individual financial goals and needs and selecting investments in asset classes with different risk parameters, such as stocks and bonds, we can create a custom-tailored and diversified investment portfolio.

INDIVIDUAL SECURITY SELECTION

Stock Selection

In determining the companies that may be appropriate for our investment recommendations, we utilize a quantitative screen to limit the number of potential candidates in any one sector. This allows our analysts a greater ability to look deeply at the fundamentals of a few names.

Bond Selection

Bond portfolios are constructed to provide income and minimize portfolio risk and volatility.

At EP Wealth Advisors, we emphasize:

- Duration management, including laddered, barbell, or bullet maturities to minimize risk

- Strategic positions along the yield curve

- Sector and quality diversification

- Close monitoring of changes in bond/credit ratings

MUTUAL FUNDS

An Agnostic Approach to Portfolio Construction

We believe there is more to active management than simply determining whether underlying managers are seeking to outperform or simply track an underlying index. We don't have a bias to certain types of investment vehicles (e.g., ETF, mutual fund, individual stock, etc.) - no matter which is used, our core philosophy as wealth managers is to continually monitor and manage our clients' financial plans and the investments associated with them.

In case where actively-managed mutual funds are used, our manager search criteria follows a transparent and consistent process based on:

- Reasonable fees

- Manager tenure

- Performance track record relative to peers and corresponding benchmarks

Our mutual fund portfolio allocation process is broken down into two stages:

- Initial Due Diligence: We partner with outside managers in niche and/or less efficient markets whenever we feel a competent, specialized team can add value relative to passive investments like index funds or ETFs.

- Ongoing Due Diligence: To ensure that select mutual funds are performing to expectations, meetings are held with outside fund managers to review performance and confirm no significant changes to process or personnel have taken place.

WHAT TO EXPECT FROM A MANAGED

INVESTMENT PORTFOLIO

Your Current Investment Strategy May Need to Change in the Future

Humans, by nature, can be resistant to change, yet this can sometimes limit our opportunities for financial growth. Working with an investment manager can help you stay the course or adjust to changes in your situation or market conditions.

All financial markets follow cycles of growth and contraction, and as the environment changes, we adjust your investment strategy towards growth.We carefully monitor market trends and historical data and make adjustments as needed.

Investment diversification helps lessen potential volatility because it reduces the material impact of one poorly performing investment on your portfolio.

In addition, by actively managing your investments, we can create more opportunities for tax-loss harvesting. For example, when certain investments in your portfolio are down, we can sell those investments to offset the taxable gains from other parts of your portfolio which are up in value.

FIND A FINANCIAL ADVISOR NEAR YOU

Our breadth of coverage across the U.S. means we’re local—here to serve your needs at your convenience.